Does Cash App Charge You To Send Money

Owned by Block (the fintech company formerly known as Square), Cash App allows users to send and receive money virtually, brand online and in-person payments, and invest in stocks and cryptocurrency. Information technology's best known for its peer-to-peer payment functionality, which competes against major players similar Venmo and PayPal.

If y'all're thinking about using Cash App for whatsoever of these purposes, there are a few things you should know. Below, you'll discover an in-depth review of the service, including how it works and how to open an account.

What is Cash App?

Cash App launched in 2013, providing a convenient way for users to transport and receive coin -- without going through a bank or wire service. In the years since, it has expanded its offering and now provides other services similar Cash App-continued debit cards, support for direct deposit, and an investment platform. Users also take admission to cashback offers (chosen "Boosts") from retailers and restaurants like McDonald's, Walgreens, Walmart, and Whole Foods.

Every bit its name would suggest, Cash App is primarily a smartphone app (available on the App Shop and Google Play). It's likewise accessible through browsers like Chrome and Safari.

How does Cash App work?

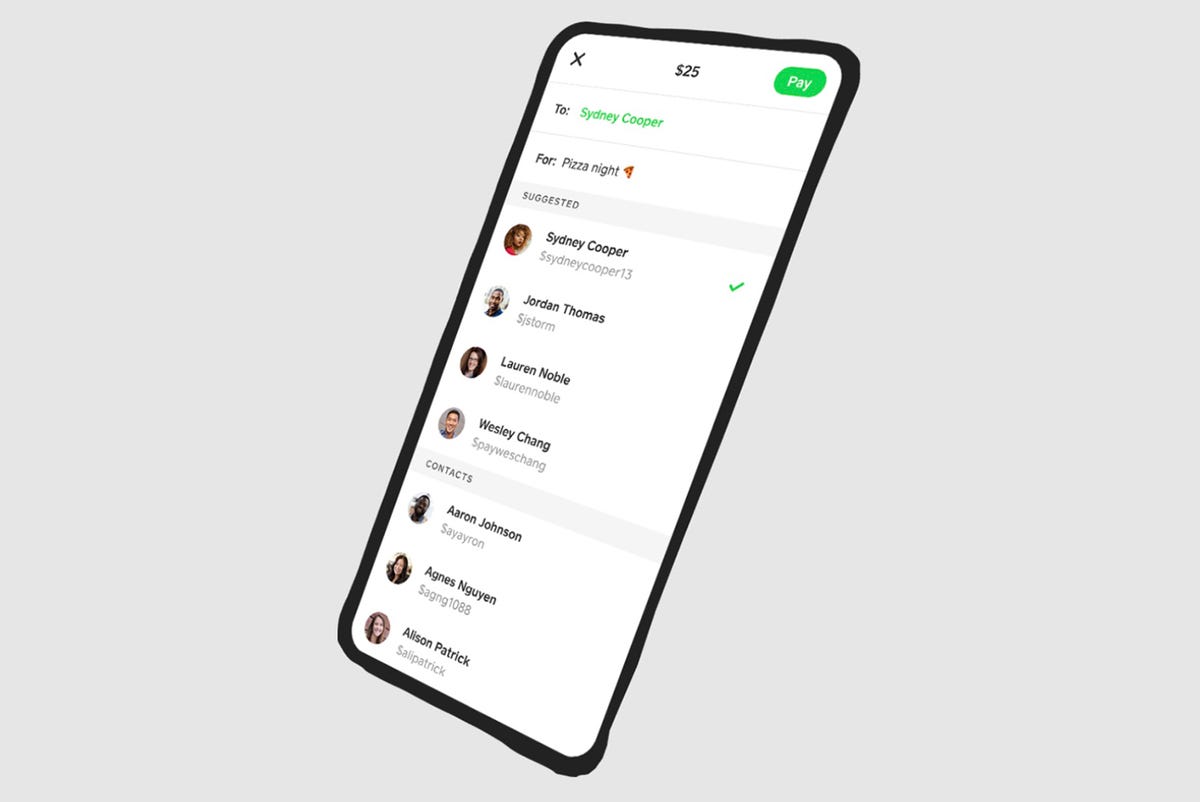

The platform lets customers pay or request money from other users who accept connected a bank account, credit card, or debit carte du jour. Prepaid cards tin can also be used to add money to Cash App, only y'all tin't transfer your Greenbacks App balance to a prepaid carte.

In many ways, Cash App functions like a traditional bank business relationship. Once you've signed up, you'll become an account number and a routing number. So you can deposit cash, gear up direct eolith with your employer, and get a debit card (called a "Cash Card"). However, it's important to note that Cash App is a financial platform -- non a bank. The company partners with banks to provide banking services (like issuing debit cards and setting up direct deposits).

When you're ready to transfer money from Greenbacks App to your bank account, you lot can initiate a deposit through the app or your browser. Standard deposits are gratis and usually take two to iii days to procedure, while instant deposits come up with a 0.v% - i.75% fee (minimum of $0.25) and get in in your bank account right abroad.

If you'd prefer to pay for goods and services using your Greenbacks App balance, you tin can practice and then by using your Greenbacks Card -- both online and at brick-and-mortar stores. Or, if you're buying from a merchant that uses Square, yous can open Cash App and scan the QR code on their point-of-sale system or on their website.

How do you lot open a Cash App account?

No matter how yous want to apply Cash App, your first pace is to create an account. You'll be prompted to link your banking concern account (either using your debit card or routing and business relationship numbers) during that procedure. Then, y'all'll need to create a unique username (known as a "$Cashtag"), which lets other users find yous and send or request funds.

From there, you can initiate payments, eolith coin, and cash out your balance into your traditional banking company business relationship. If you have a Cash Card, y'all can use it to withdraw money at ATMs and make mobile payments with Apple Pay or Google Pay.

You lot can also use your Cash App account to buy stocks and Bitcoin. If you lot're feeling extra generous, you tin can fifty-fifty ship stocks to your loved ones every bit a gift.

Tin can you ship money overseas with Cash App?

With Cash App, y'all tin send money to users in the United States and the United kingdom. If you're sending funds from the United states to the UK, the visitor will automatically catechumen the money from USD to GBP (depending on the mid-market current commutation charge per unit).

Does Cash App let you get cash out from ATMs?

Yep, if you lot asking a debit card with your Cash App account. Some fees may utilize (more data near that beneath).

What fees does Greenbacks App charge?

If yous take a debit carte or bank account linked to your Cash App, you won't pay whatsoever fees to receive or send coin. But if you lot're sending money with a credit card, in that location'due south a 3% fee per transaction.

Greenbacks App charges $ii per ATM withdrawal made with a Greenbacks Card (on top of any fees the ATM owner charges). However, if you lot've received at least $300 in direct deposit payments into your business relationship, the company will reimburse three ATM fees per 31 days (up to $7 per withdrawal).

At that place's no cost to use the investing component of Cash App'due south platform, merely you may be charged a pocket-sized fee when buying or selling Bitcoin.

Can businesses use Cash App?

If you're a small business organization possessor, you can use Cash for Business to accept payments and instantly deposit them into your banking company account for free. All the same, the company does charge some fees for the service, including 2.v% per transaction and 2.75% for each payment made by credit card.

Is Cash App secure?

Greenbacks App is PCI Information Security Standard (PCI-DSS) Level 1 compliant, which is the highest level of security compliance for merchants that process payments. As a customer, this means that your data is encrypted and secure.

Yous can amend the security of your Greenbacks App business relationship by setting up 2-gene authentication, requiring a PIN to transfer funds, and turning on notifications for business relationship activity. If your card is lost or stolen, you lot tin disable it to foreclose fraudulent charges.

What are some Cash App alternatives?

When it comes to Cash App'southward main functionality (peer-to-peer money transfers), the company's primary competitors are Venmo, Zelle, and PayPal. Hither'due south how it stacks up against each of these services:

- Venmo:For the most function, this PayPal-owned app is pretty similar to Cash App. Both platforms let users pay and request money from others, use a debit card, set up direct deposit, and brand online and in-store payments. However, Venmo does offer social media-like functionality (such as likes and comments on payments) and purchase protection -- merely information technology's only available in the U.s.a..

- Zelle: Zelle works straight with major banks (including Chase, Wells Fargo, and Depository financial institution of America) to process same-day payments between its users. If you bank with one of its partners, you can brand payments directly from your online banking business relationship, so there's no demand to download the Zelle app.

- PayPal: Established about 25 years ago, PayPal rules the online payment space. It includes far more bells and whistles than Greenbacks App, including the ability to make international payments, create and ship business invoices, and pay for purchases in installments.

Source: https://www.zdnet.com/finance/what-is-cash-app-and-how-does-it-work-a-comprehensive-guide/

Posted by: motonandeten87.blogspot.com

0 Response to "Does Cash App Charge You To Send Money"

Post a Comment